Don’t overlook the importance of solid offshore trusts asset protection strategies.

Don’t overlook the importance of solid offshore trusts asset protection strategies.

Blog Article

Checking out the Perks of Offshore Trust Fund Possession Security for Your Riches

When it comes to safeguarding your wide range, offshore trust funds can provide considerable benefits that you may not have actually taken into consideration. These depends on offer a critical layer of protection versus financial institutions and lawful insurance claims, while likewise boosting your privacy. And also, they can open doors to one-of-a-kind financial investment chances. Interested regarding just how these benefits can influence your economic future and estate planning? Let's discover what offshore depends on can do for you.

Understanding Offshore Trusts: A Guide

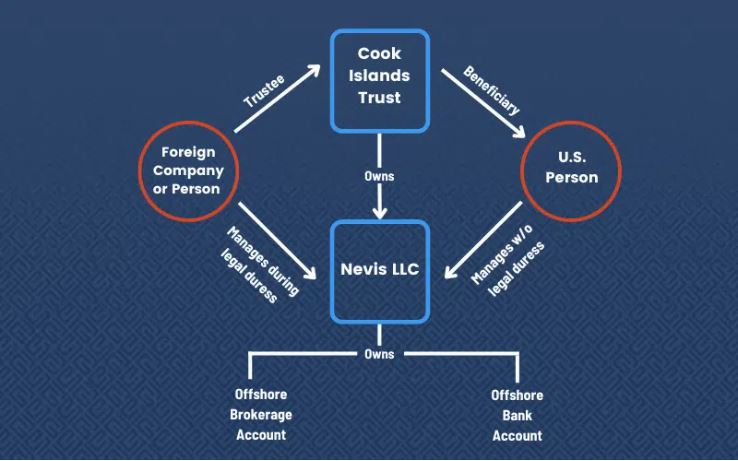

Offshore trust funds offer a special way to manage and safeguard your possessions, and recognizing their basics is crucial. These trusts permit you to put your riches outside your home country, frequently in jurisdictions with desirable tax obligation legislations and privacy defenses. When you set up an offshore trust, you're essentially transferring your properties to a trustee, who handles them according to your specified terms. This framework can help you keep control over your wealth while lowering direct exposure to regional responsibilities and taxes.

In addition, offshore trusts typically provide confidentiality, shielding your financial affairs from public examination. By understanding these basics, you can make educated decisions about whether an offshore trust aligns with your possession security method and lasting financial objectives.

Lawful Protections Supplied by Offshore Trusts

When you develop an overseas count on, you're taking advantage of a durable framework of lawful securities that can secure your possessions from numerous threats. These trust funds are typically regulated by beneficial regulations in overseas jurisdictions, which can offer stronger defenses versus financial institutions and lawful cases. Many offshore trust funds benefit from statutory defenses that make it tough for lenders to access your assets, also in personal bankruptcy circumstances.

Furthermore, the separation of legal and beneficial possession suggests that, as a beneficiary, you do not have straight control over the possessions, making complex any attempts by financial institutions to take them. Numerous overseas territories also restrict the moment structure in which claims can be made against counts on, including one more layer of safety. By leveraging these lawful securities, you can considerably enhance your economic stability and safeguard your wide range from unanticipated hazards.

Privacy and Discretion Benefits

Establishing an offshore trust fund not only provides robust legal securities yet likewise guarantees a high degree of personal privacy and confidentiality for your properties. When you established up an offshore depend on, your monetary events are secured from public examination, helping you preserve discernment concerning your wealth. This confidentiality is important, particularly if you're worried about prospective lawsuits or unwanted focus.

In many offshore jurisdictions, legislations shield your individual information, suggesting that your assets and financial dealings stay exclusive. You will not need to worry about your name showing up in public documents or monetary disclosures. Additionally, functioning with a reliable trustee makes certain that your information is managed safely, additional boosting your personal privacy.

This level of privacy enables you to manage your riches without concern of exposure, offering tranquility of mind as you secure your monetary future. Ultimately, the personal privacy benefits of an overseas trust fund can be a considerable advantage in today's progressively clear world.

Tax Obligation Benefits of Offshore Counts On

Among one of the most compelling reasons to contemplate an offshore trust is the capacity for considerable tax benefits. Establishing up an overseas trust fund can assist you lower your tax responsibilities legitimately, relying on the jurisdiction you select. Lots of offshore jurisdictions use desirable tax obligation prices, and in some cases, you might even benefit from tax obligation exemptions on earnings produced within the trust.

By transferring possessions to an overseas trust, you can divide your personal riches from your gross income, which might reduce your general tax worry. Additionally, some territories have no resources gains tax obligation, enabling your financial investments to grow without the instant tax implications you 'd deal with domestically.

Possession Diversification and Financial Investment Opportunities

By developing an offshore trust fund, you open the door to property diversification and distinct investment opportunities that may not be offered in your home nation. With an overseas depend on, you can access various international markets, permitting you to Find Out More buy property, supplies, or commodities that may be limited or much less desirable domestically. This global reach helps you spread out risk throughout various economic climates and industries, protecting your riches from regional economic recessions.

Additionally, overseas counts on commonly supply accessibility to specialized investment funds and alternative properties, such as personal equity or hedge funds, which could not be offered in your house market. These options can improve your profile's development possibility. By expanding your financial investments globally, you not only reinforce your monetary placement but also acquire the flexibility to adjust to transforming market problems. This tactical method can be important in preserving and growing your wide range over time.

Sequence Preparation and Wealth Transfer

When taking into consideration how to pass on your wide range, an overseas count on can play an important duty in effective succession planning. By developing one, you can guarantee that your assets are structured to offer for your liked ones while reducing prospective tax implications. An offshore count on enables you to determine just how and when your beneficiaries receive their inheritance, giving you with satisfaction.

You can select a trustee to handle the depend on, assuring your wishes are performed even after you're gone (offshore trusts asset protection). This arrangement can additionally protect your assets from creditors and legal challenges, protecting your family's future. In addition, overseas depends on can provide personal privacy, maintaining your financial issues out of the general public eye

Inevitably, with cautious preparation, an overseas count on can offer as an effective tool to facilitate wealth transfer, ensuring that your tradition is managed and your loved ones are dealt with according to your dreams.

Selecting the Right Territory for Your Offshore Trust

Choosing the best territory for your overseas count on is a crucial aspect in optimizing its advantages. You'll intend to consider elements like legal framework, tax ramifications, and property security legislations. Different jurisdictions supply differing levels of discretion and stability, so it is vital to study each alternative extensively.

Search for areas understood for their beneficial trust legislations, such as the Cayman Islands, Bermuda, or Singapore. These jurisdictions commonly supply durable legal defenses and an online reputation for monetary protection.

Also, think of availability and the simplicity of managing your depend on from your home nation. Consulting with a lawful professional concentrated on offshore counts on go can guide you in guiding through these complexities.

Inevitably, selecting the optimal territory can improve your possession protection strategy and assure your riches is guarded for future generations. Make educated decisions to protect your economic tradition.

Often Asked Concerns

Can I Establish up an Offshore Trust Fund Without a Lawyer?

You can technically establish up an overseas count on without an attorney, yet it's risky. You might miss out on important lawful subtleties, and complications can emerge. Hiring an expert assurances your depend on conforms with policies and secures your interests.

What Happens if I Relocate to An Additional Country?

Are Offshore Trusts Legal in My Nation?

You'll need to inspect your local regulations to figure out if offshore trusts are lawful in your country. Regulations differ widely, so consulting a legal professional can aid assure you make informed choices about your assets.

Exactly How Are Offshore Trust Funds Regulated Internationally?

Offshore trusts are controlled by worldwide legislations and guidelines, differing by jurisdiction. You'll locate that each nation has its very own rules relating to tax, reporting, and compliance, so it's vital to recognize the specifics for your circumstance.

Can I Access My Assets in an Offshore Trust Fund?

Yes, you can access your possessions in an overseas trust, yet it depends on the count on's structure and terms. You must consult your trustee to understand the details processes and any type of restrictions involved.

Verdict

To sum up, offshore counts on can be a wise option for safeguarding your wealth. When considering an overseas trust, take the time to choose the appropriate jurisdiction that aligns with your objectives.

Report this page